National

Major announcements in Personal Income Tax in Union Budget 2023-24

⇒ Union Minister for Finance and Corporate Affairs, Smt Nirmala Sitaraman made five major announcements with respect to personal income tax while presenting the Union Budget 2023-24 in Parliament on 01 February 2023.

These announcements pertaining to rebate, change in tax structure, extension of benefit of standard deduction to the new tax regime, reduction of highest surcharge rate and extension of limit of tax exemption on leave encashment on retirement of non-government salaried employees. This will provide substantial benefits to the working middle class.

1. Rebate:

- The rebate limit has been increased to Rs 7 lakh in the new tax regime, which would mean that the persons in the new tax regime, with income up to Rs 7 lakh will not have to pay any tax.

- Currently, those with income up to Rs 5 lakh do not pay any income tax in both old and new tax regimes.

2. Change in tax structure:

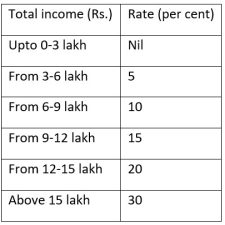

Providing relief to middle-class individuals, the tax structure has been changed in the new personal income tax regime by reducing the number of slabs to five and increasing the tax exemption limit to Rs 3 lakh.

The new tax rates are:

3. Extension of benefit of standard deduction to the new tax regime:

- The third proposal of the budget provides major relief to the salaried class and the pensioners including family pensioners as the Finance Minister proposed to extend the benefit of standard deduction to the new tax regime.

- Each salaried person with an income of Rs 15.5 lakh or more will thus stand to benefit by Rs 52,500.

- At present, standard deduction of Rs 50,000 to salaried individuals and deduction from family pension up to Rs 15,000 is currently allowed only under the old regime.

4. Reduction of highest surcharge rate:

- The highest surcharge rate has been reduced from 37 per cent to 25 per cent in the new tax regime for income above Rs 2 crore.

- This would result in reduction of the maximum tax rate to 39 per cent from the present 42.74 per cent, which is among the highest in the world.

- However, no change in surcharge is proposed for those who opt to be under the old regime in this income group.

5. Extension of limit of tax exemption on leave encashment on retirement of non-government salaried employees:

- The budget proposed extension of limit of tax exemption on leave encashment to Rs 25 lakh on retirement of non-government salaried employees in line with the government salaried class. At present, the maximum amount which can be exempted is Rs 3 lakh.

» The budget proposed to make the new income tax regime as the default tax regime. However, citizens will continue to have the option to avail the benefit of the old tax regime.

Nominal GDP to Grow at 15.4 % in FY 2022-23

⇒ Union Minister of Finance and Corporate Affairs Smt Nirmala Sitharaman presented the Statements of Fiscal Policy along with Union Budget 2023-24 in Parliament on 01 February 2023.

According to the Fiscal Policy statements the Nominal GDP is projected to grow at 15.4 % year-on-year (Y-o-Y) in FY2022-23 as against 19.5% in 2021-22. The real GDP is projected to grow by 7% (Y-o-Y) relative to 8.7% in 2021-22.

Sector wise Growth:

- Fiscal policy statements highlighted that Indian agriculture sector is projected to grow by 3.5 per cent in FY 2022-23.

- The industry sector to witness modest growth of 4.1 per cent in FY 2022-23 relative to 10.3 per cent in FY 2021-22. The domestic auto sales registered Y-o-Y growth of 5.2 % in December 2022 and robust domestic tractor, two and three-wheelers sales during Q3 of FY 2022-23 which also signified improvement in rural demand.

- The services sector to rebound with y-o-y growth of 9.1% in FY 2022-23 over 8.4 % in 2021-22. On the demand side, private consumption has witnessed continued momentum. It is estimated to grow at 7.7 per cent in FY 2022-23 compared to 7.9 per cent in FY 2021-22.

- Exports are estimated to grow at 12.5 per cent in FY 2022-23 despite sustained supply chain disruptions and an uncertain geopolitical environment. The share of exports in GDP (at 2011-12 prices) also increased to 22.7 per cent in FY 2022-23 compared to 21.5 per cent in FY 2021-22.

» The Statement of Fiscal Policy observed that Growth in FY 2023-24 will be supported by solid domestic demand and a pickup in capital investment. The current growth trajectory will be supported by multiple structural changes like IBC and GST that have enhanced the efficiency and transparency of the economy and ensured financial discipline and better compliance.

Fiscal Deficit to be at 5.9% in FY 2023-24

⇒ Union Minister for Finance and Corporate Affairs Smt. Nirmala Sitharaman presented the Union Budget 2023-24 in the Parliament on 01 February 2023.

Smt Sitharaman said that ‘continuing the path of fiscal consolidation, the Government intends to bring the fiscal deficit below 4.5 per cent of GDP by 2025-26.’

Fiscal deficit:

» The fiscal deficit is estimated to be 5.9 per cent of GDP in BE 2023-24.

- To finance the fiscal deficit in 2023-24, the net market borrowings from dated securities are estimated at Rs 11.8 lakh crore. The balance financing is expected to come from small savings and other sources. The gross market borrowings are estimated at Rs 15.4 lakh crore.

In Budget Estimates 2023-24, the total receipts other than borrowings and the total expenditure are estimated at Rs 27.2 lakh crore and Rs 45 lakh crore respectively. Moreover, the net tax receipts are estimated at Rs 23.3 lakh crore.

In the Revised Estimate 2023-24, the total receipts other than borrowings is Rs 24.3 lakh crore, of which the net tax receipts are Rs 20.9 lakh crore. The Revised Estimate of the total expenditure is Rs 41.9 lakh crore, of which the capital expenditure is about Rs 7.3 lakh crore. The Revised Estimate of the fiscal deficit is 6.4 per cent of GDP in RE 2022-23, adhering to the Budget Estimate.

Revenue deficit:

The Finance Minister stated that the revenue deficit is expected to be at 2.9 % in FY 2023-24 over 4.1% in 2022-23.

Tax revenue:

Gross Tax Revenue (GTR) is projected to grow at 10.4 per cent in FY 2023-24 over FY 2022-23. Both, the Direct and Indirect Tax receipts are individually estimated to grow at 10.5 per cent and 10.4 per cent, respectively. The Tax to GDP ratio is estimated at 11.1 per cent.

The balance between Revenue receipts and Revenue expenditure

The total revenue receipts and revenue expenditure of the Centre are estimated at Rs 26.32 lakh crore and Rs. 35.02 lakh crore, respectively, in BE 2023-24. Tax-GDP ratio has improved from 10.7 per cent in BE 2022-23 to 11.1 per cent in RE 2022-23 and BE 2023-24

Non tax revenue

Non-Tax Revenue is estimated to contribute 11.5 per cent of the Revenue Receipt and is projected to be at Rs 3.02 lakh crore which is 15.2 per cent more than the RE 2022-23 of Rs 2.62 lakh crore.

Capital expenditure to Fiscal Deficit Ratio

The ratio of capital expenditure to Fiscal Deficit (Capex-FD) is estimated at 56.0 per cent in BE 2023-24 as compared to 41.5 per cent in RE 2022-23 and 37.4 per cent in FY 2021-22.

Fiscal Deficit of States:

The States will be allowed a fiscal deficit of 3.5 per cent of GSDP of which 0.5 per cent will be tied to power sector reforms. States will also be provided a fifty-year interest free loan. The entire fifty-year loan to states has to be spent on capital expenditure within 2023-24.

Important Day

31st Foundation Day event of National Commission for Women

⇒ The President of India, Smt Droupadi Murmu graced the 31st Foundation Day Celebrations of National Commission for Women in New Delhi on 31 January 2023.

Union Minister for Women and Child Development Smt Smriti Zubin Irani, MoS WCD Shri Dr. Munjpara Mahendrabhai and Chairperson, NCW, Ms Rekha Sharma and Secretary, WCD Shri Indevar Pandey also graced the occasion.

During the event, Union WCD Minister Smt Smriti Zubin Irani launched the Commission’s journey book “Sashakt Nari, Sashakt Bharat” and presented the first copy to the President.

About Celebration:

» The National Commission for Women has organized a two-day event to celebrate its 31st Foundation Day from 31st January, 2023 to 1st February, 2023.

Theme:

The theme of the programme was ‘Sashakt Nari Sashakt Bharat’ aimed at acknowledging and celebrating the stories of women who have excelled and paved their journey to leave a mark.

» On the second day, a panel discussion was held with extraordinary women who have led the path of inspiration and empowerment for several others.

About NCW:

- NCW was founded in January 1992 as a statutory body under the National Commission for Women Act, 1990.

- It was established to review the constitutional and legal safeguards for women, recommend remedial legislative measures, facilitate redressal, or grievances, and advise the government on policy matters affecting women.

- The First Commission was constituted on 31st January 1992 with Mrs. Jayanti Patnaik as the Chairperson.